35+ cost of private mortgage insurance

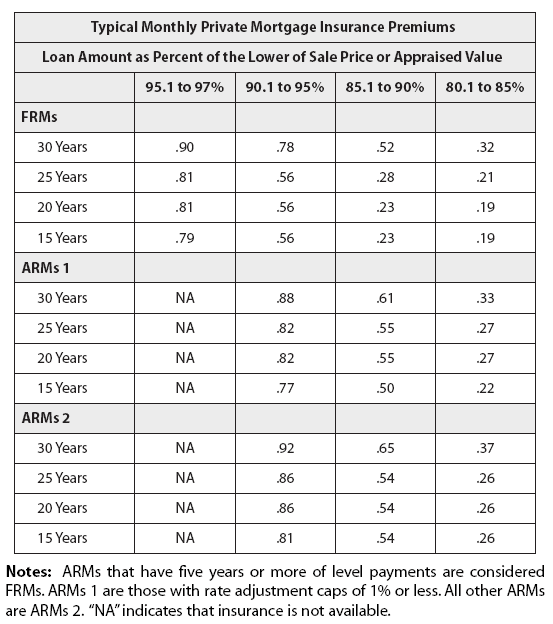

Web The table below shows how quickly PMI costs can add up based on factors like down payment credit score debt-to-income DTI ratio and how many people are applying for the loan. As a general rule PMI expenses are higher for larger mortgages.

What Is A Private Mortgage Insurance On Mortgage In Nyc Nestapple

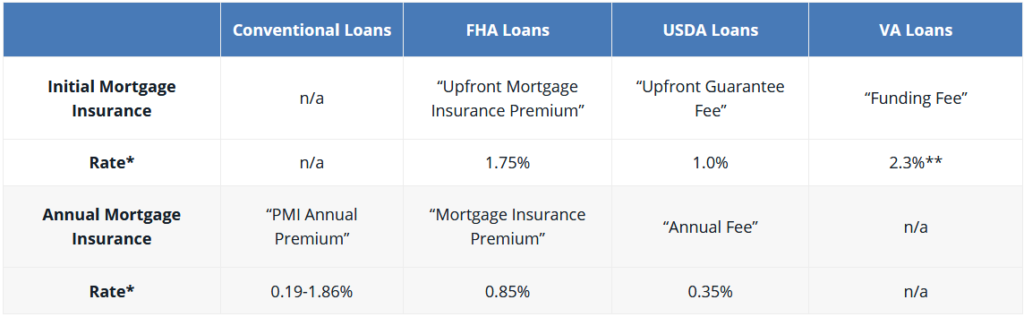

Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from 017 to 186 of the loan amount or 170.

. Web Your PMI costs vary by your loan program and other factors. In Washington DC buyers. PMI is calculated as a percentage of your total loan amount and generally ranges between 058 and 186.

Web At those rates PMI on a 300000 mortgage would cost 1740 to 5580 per year or 145 to 465 per month. Even though it protects the lender and not you it is paid by you. At those rates PMI could cost anywhere from.

235000 loan - 075 premium. Lenders typically charge borrowers with high credit scores lower PMI percentages. Web Assuming a PMI insurance rate of 051 Freddie Mac estimates that homebuyers pay around 30 to 70 each month per 100000 borrowed.

PMI premiums could cost you anywhere up to 100 of your loan amount per year. Web The Cost of Private Mortgage Insurance. The cost of PMI varies based on insurance rates and the borrowers credit score but is usually between 00022 to 0025 of the principal loan amount.

Web Private Mortgage Insurance or PMI is insurance that protects the lender against loss if you the borrower stop making mortgage payments. Web PMI costs can range from 05 to 2 of your loan balance per year depending on the size of the down payment and mortgage the loan term and the borrowers credit score. There are specific factors that may affect how much a borrower will have to pay for Private.

Loan-to-value ratio LTV Terms of loan. Annual premium range for PMI as of September 2020. The costs for PMI vary on a lender-to-lender basis but key factors that determine them are.

How much you pay depends on two main factors. In other words annual PMI premiums usually range from 05 to 2 of the outstanding principal. Web The cost of PMI varies based on a number of factors but generally speaking Freddie Mac estimates it costs between 30 and 150 per month for every 100000 borrowed.

As of 2022 Freddie Mac estimates that PMI costs 30 to 70 per month for every 100000 borrowed. Web For conventional mortgages private mortgage insurance PMI generally costs around 02 to 2 of the loan amount per yearbut can sometimes be much more. Web Private mortgage insurance costs depend on the lender and the amount you have on the loan in real.

Web What Does Private Mortgage Insurance Cost. The figures are based on a 350000 30-year fixed-rate mortgage assuming you choose monthly PMI. Web On average PMI costs range between 022 to 225 of your mortgage.

Web But in general the cost of private mortgage insurance or PMI is about 05 to 15 of the loan amount per year. The larger your loan the more PMI you will end up paying. But again this depends on your situation.

The exact amount youll pay could depend on the type of loan the insurance provider your credit score and your loan-to-value LTV ratio. Web Regardless of the value of a home most mortgage insurance premiums cost between 05 and as much as 5 of the original amount of a mortgage loan per year. The more the borrower is considered a risk the higher their rate for PMI insurance.

That means if 150000 was borrowed and the annual premiums cost 1 the borrower would have to pay 1500 each year 125 per month to insurance their mortgage. Web The amount youll pay depends on the size of your loan the amount of your down payment and your credit score. Web Private mortgage insurance costs between 30 to 70 per month for every 100000 borrowed.

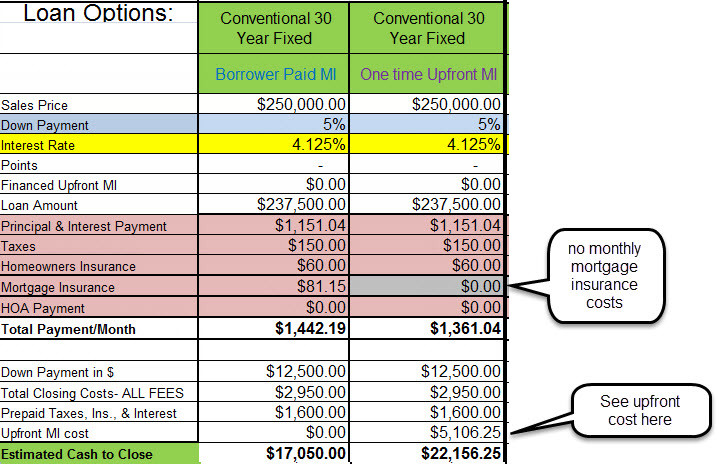

Web Those averages were calculated using a 289500 mortgage the loan balance youd have if you bought a 300000 home and made a 35 down payment. This annual premium is broken into monthly installments which are added to. The exact amount youll pay could depend on the type of loan the insurance provider your credit scores and your loan-to-value LTV ratio.

For example Urban Institute bases the above percentages on a 275000 home with a 965 loan-to-value LTV ratio. Web That equates to paying 19083 per year or 1590 per month in PMIthe insurance required on conventional loans when the borrower has a down payment of less than 20. Average annual PMI premium PMI calculator help Home price.

It may allow you to buy a house with a much smaller down payment as low as three to five percent of the price of the house instead of the. Web For conventional mortgages private mortgage insurance PMI generally costs around 02 to 2 of the loan amount per year but can sometimes be much more. According to the Urban Institute PMI generally ranges between 058 to 186 of the annual loan balance broken down into monthly installments.

Your total loan amount. 1 The greater your.

How Much Is A Private Mortgage Insurance Filehik Com

Pmi Mortgage Insurance Calculator Casaplorer

August 23 2012 The Citizen By Advantipro Gmbh Issuu

How Much Is Pmi Private Mortgage Insurance

Pmi Mortgage Insurance Calculator Casaplorer

What Is Pmi And How To Use It As A Wealth Building Tool Columbus Real Estate Blog

The Mortgage Brothers Show Signature Home Loans Phoenix Az

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

Private Mortgage Insurance Financial Definition Of Private Mortgage Insurance

Fha Loan Calculator Check Your Fha Mortgage Payment

Average Down Payment For A House Here S What S Normal

Mortgage Insurance How Much Is Pmi

Home Appraisal And Your Property Value

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

What Is Pmi Understanding Private Mortgage Insurance

Pmi Guide To Private Mortgage Insurance Bankrate

Private Mortgage Insurance Calculator How To Avoid Pmi Moneygeek